Over the past decade, insurance companies have become more

active on the construction side of lending in efforts to (1) earn more yield on

their loan dollars and (2) provide early opportunities for permanent loan

business on newly-built, high quality stabilized product. As a result, many

have developed non-recourse construction and construction-to-perm lending

programs. Currently, 8-10 of our insurance company relationships are active in

this space, especially on deals with loan sizes greater than $25M.

With the volatility brought by the COVID pandemic, many

insurance companies temporarily halted their construction or

construction-to-perm lending programs in efforts to minimize risk. However,

markets have since stabilized and many lenders have re-entered the scene with

an appetite for opportunities with strong fundamentals. Lenders are currently pursuing

construction loans for the following property types: multifamily, industrial,

and office properties (with significant pre-leasing or build-to-suits).

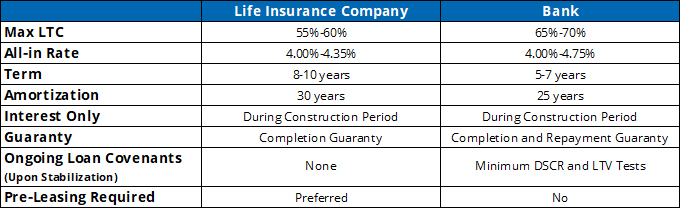

Life companies have been successful in implementing their

construction / construction-to-perm loan programs, even during the current

pandemic, and have served as an attractive alternative to the traditional bank

options. We’ve worked on several recent construction loans with both our key

life company and banking relationships, and here’s how the two categories of

lenders compare right now:

On the life company side, there are some notable exceptions

to the general terms shown above:

- Some groups are quoting coupons in the 3.25%-3.75% range,

specifically for multifamily and industrial with some pre-leasing activity.

- Some lenders are offering an interest only period even after

the loan converts to permanent status.

- A select group of life companies has an appetite for 5-year

floating rate construction loans. These are typically sized to 60% LTC, are

non-recourse (with a completion guaranty) and are priced based on a spread over

LIBOR.

Banks are also able to occasionally offer more attractive

terms to those listed above, including:

- Some banks have been able to approve 75% LTC requests on

certain deal profiles.

- Banks are able to pursue smaller deal sizes <$25M.

- Banks can offer minimal prepayment penalties to provide an

investor with more flexibility during the permanent portion of the loan.

Depending on a borrower’s investment strategy, banks are a

great option for higher leverage requests and shorter investment horizons. They

are typically able to accommodate greater risk profiles (spec development) with

the necessary structure in place and can lend on smaller balance loans that

other capital sources can’t.

Alternatively, the life company route can be more

appropriate for borrowers with larger deals that are looking to build, lease up

and hold the property long term once its stabilized. This option allows for

construction financing to be obtained while taking refinancing risk off the

table and minimizing on-going covenant monitoring and reporting after

construction is complete.

Our longstanding relationships with both life companies and

local/regional banks allows Essex to create competition across multiple capital

sources to ensure the best execution for its borrowers that are pursuing

construction-to-perm loan options.